Your cart is currently empty!

The Hidden Costs: What the City Isn’t Telling You About the $150 Million Millage

The city has been promoting its 1.43 mill tax proposal as costing the “average” Livonia homeowner only about $180 per year. This figure appears on their official tax calculator and in promotional materials, but it presents an incomplete—and ultimately misleading—picture of what homeowners will actually pay over the 25-year life of this millage.

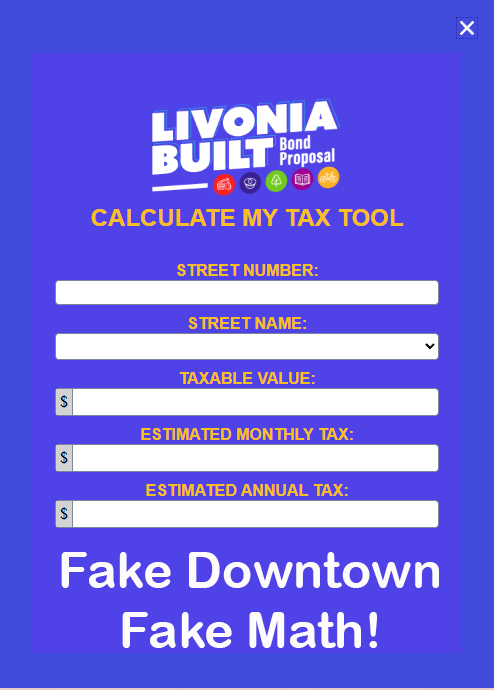

What the City’s Tax Calculator Doesn’t Show

The city’s tax calculator makes a critical omission: it fails to account for rising property values over the 25-year period of the millage. This is not a minor oversight—it’s a fundamental flaw that significantly understates the long-term cost to homeowners.

Let’s do the math the city won’t show you:

Scenario for an Average Livonia Home

- Current average home value in Livonia: $300,000

- Current taxable value (50% of market value): $150,000

- Initial annual tax at 1.43 mills: $214.50 per year

But property values historically increase over time. Even with a conservative annual appreciation rate of 3% (below the historical average in our region), the numbers change dramatically:

Real Cost Examples: From Average to Luxury

Let’s look at the financial impact on two different Livonia homeowners:

Scenario for an Average Livonia Home

- Current average home value in Livonia: $300,000

- Current taxable value (50% of market value): $150,000

- Initial annual tax at 1.43 mills: $214.50 per year

With property values increasing at a conservative annual rate of 3%:

Year 1:

- Taxable value: $150,000

- Annual tax: $214.50

Year 10:

- Taxable value (with increases capped at inflation): ~$185,000

- Annual tax: $264.55

Year 20:

- Taxable value: ~$237,000

- Annual tax: $339.91

Year 25 (final year):

- Taxable value: ~$275,000

- Annual tax: $393.25

Total paid over 25 years: Approximately $7,500

Scenario for a High-End Livonia Home

For Livonia’s luxury properties (which can sell for $500,000 or more):

- Current home value: $550,000

- Current taxable value (50% of market value): $275,000

- Initial annual tax at 1.43 mills: $393.25 per year

With the same property value increase:

Year 1:

- Taxable value: $275,000

- Annual tax: $393.25

Year 10:

- Taxable value: ~$339,000

- Annual tax: $484.77

Year 20:

- Taxable value: ~$434,000

- Annual tax: $620.62

Year 25 (final year):

- Taxable value: ~$504,000

- Annual tax: $720.72

Total paid over 25 years: Approximately $13,750

This is significantly more than these homeowners might calculate by simply multiplying the initial annual amounts by 25 years.

This Is Just One Piece of a Larger Plan

Perhaps the most concerning aspect of this millage proposal is what’s not being openly discussed: this is only Phase 3 of a broader master plan with multiple phases extending well beyond what’s currently being presented to voters. According to the city’s website (after rebranding from “downtown” to “LivoniaBuilt” following public backlash), the currently disclosed phases include:

- Phase 1 (2025): New Senior Wellness Center – $27 million (funded through grants)

- Phase 2 (2026): New City Hall – $45 million (financed through reduced spending)

- Phase 3 (2028): This $150 million bond proposal for police, fire, library, and plaza

- Phase 4 (2029): Private development of multi-family housing, retail, and restaurants

However, these four phases represent just one section of a more extensive master plan that has additional components, future costs, and variables that have not been fully disclosed to the public. The full extent of the city’s planned development—and its potential impact on taxpayers—remains largely unknown.

While the city is marketing the $150 million bond as creating a “downtown” (now rebranded as “LivoniaBuilt”), the actual downtown elements (residential units, retail spaces, and restaurants) would only come in Phase 4, which isn’t even included in this funding request. This $150 million is just for municipal buildings, with no guarantee that the promised downtown atmosphere will ever materialize.

- How many additional phases are planned

- The estimated cost of these future phases

- How they intend to fund these additional phases

- When they might seek approval for additional millages

If this initial $150 million is just the beginning, homeowners could face multiple tax increases over the coming years—none of which are being discussed alongside the current proposal.

Questions That Deserve Answers

Before voters decide on this millage, the city should provide clear answers to several critical questions:

- Why did the city rebrand this project from “downtown development” to “LivoniaBuilt” after facing public backlash, when neither accurately describes what this $150 million is actually funding?

- What additional phases exist in the full master plan beyond the four phases currently disclosed, and what are the estimated costs of these future phases?

- What is the total financial commitment residents may face over the coming decades when all phases of the complete master plan are taken into account?

- If the actual mixed-use development that constitutes a real downtown isn’t even part of this millage, why are taxpayers being asked to fund $150 million in municipal building replacements first?

- What guarantees do residents have that the Phase 4 private development will actually materialize after taxpayers have already committed $150 million to Phase 3?

- Why is the city using a tax calculator that fails to account for increasing property values over the 25-year bond period?

- Will there be additional millages requested for future phases of the master plan that haven’t yet been disclosed?

The Bottom Line

The city is asking residents to commit to a 25-year, $150 million financial obligation while providing incomplete and potentially misleading information. After facing backlash for marketing this as a “downtown” development, the city has rebranded it as “LivoniaBuilt,” but the substance remains the same: taxpayers are being asked to fund municipal building replacements with no guarantee that the promised downtown atmosphere will ever materialize.

Furthermore, these four phases represent just a portion of a broader master plan with additional components and costs that have not been fully disclosed to the public. The total financial commitment Livonia residents may face in the coming decades remains largely unknown and unaddressed in current discussions.

The tax calculator also underrepresents the true cost to homeowners by ignoring the reality of increasing property values over the 25-year period, further obscuring the actual financial impact of this proposal.

Before voting on this millage, Livonia residents deserve complete transparency about what they’re committing to—not just for the next election cycle, but for the next 25 years and beyond. They deserve honesty about the fact that this $150 million is primarily for replacing municipal buildings, not creating the vibrant downtown that was initially promised, and clarity about how this fits into the broader, long-term master plan for the city.

This is the third in a series examining Livonia’s proposed “downtown” millage. Visit FakeDowntown.com for previous articles examining what constitutes a real downtown and how the city is packaging municipal building projects under a misleading label.

Comments

One response to “The Hidden Costs: What the City Isn’t Telling You About the $150 Million Millage”

-

Thank you for putting this together. This was already an easy “no,” even before seeing this breakdown.

Keep up the good work.

Leave a Reply